AI in Finance: Smarter Investing with Algorithms

AI in Finance: Smarter Investing with Algorithms in 2025

Key Takeaways

AI is revolutionizing finance in 2025 by turning complex data into faster, smarter investment decisions that reduce costs and risk. Here’s what you need to know to leverage this transformation today:

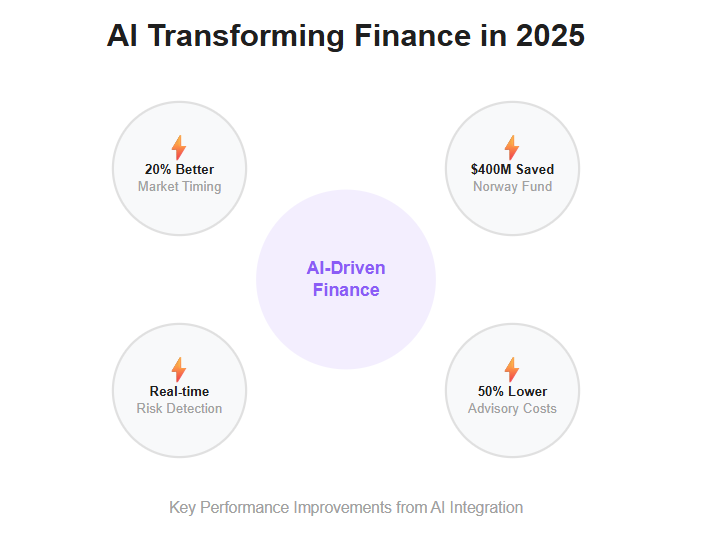

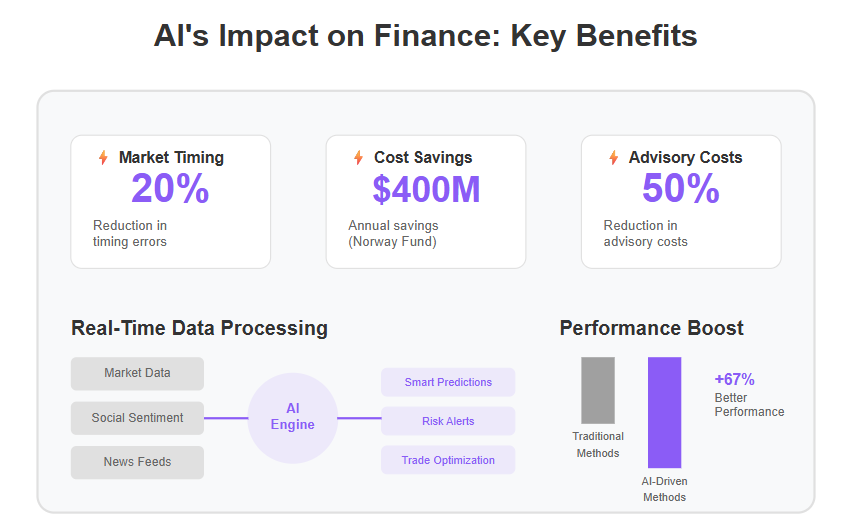

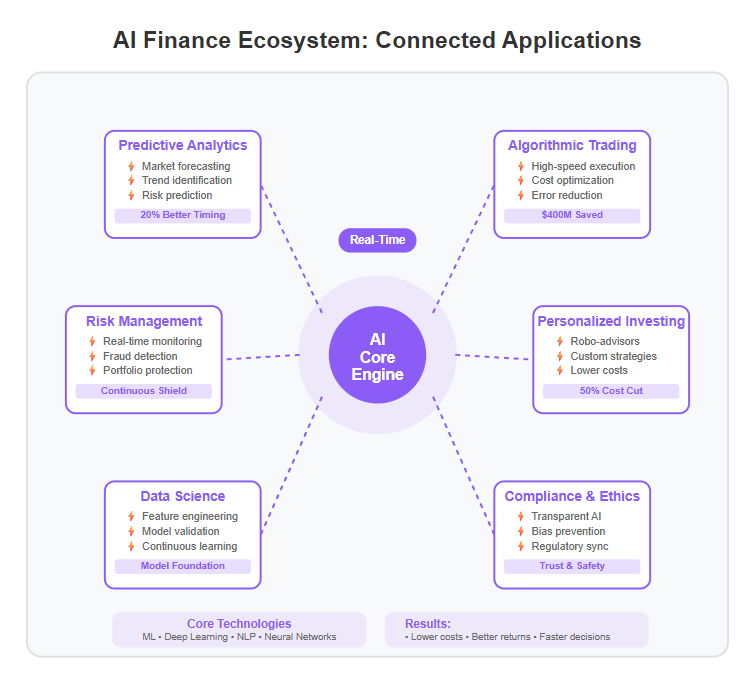

- AI-driven predictive analytics boost market timing by analyzing millions of data points—from social sentiment to economic indicators—helping investors reduce timing errors by up to 20%.

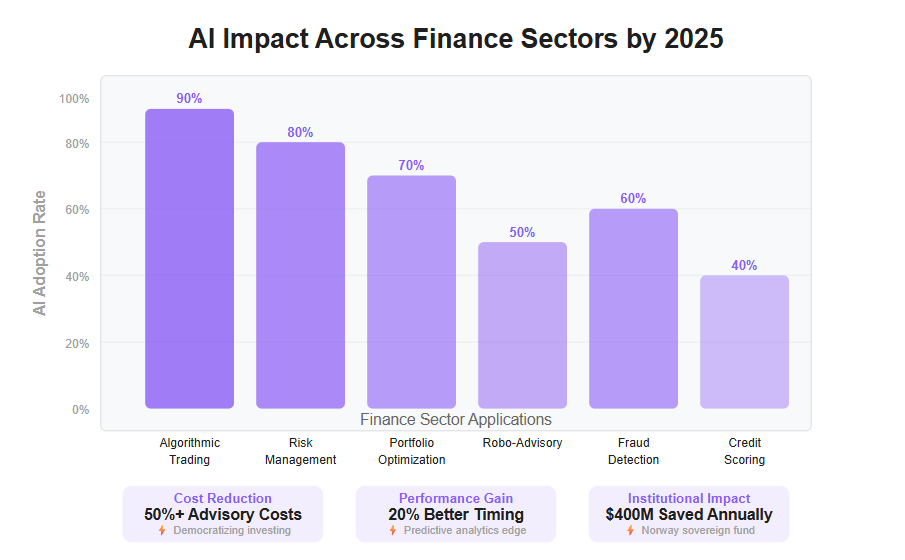

- Algorithmic trading delivers lightning-fast, precise execution and cuts costs significantly, with examples like Norway’s sovereign wealth fund saving $400 million annually by automating trade strategies.

- Human-AI collaboration is the new standard: AI flags anomalies and optimizes trades, while humans apply judgment, avoiding costly errors such as multi-million-dollar losses.

- AI-powered risk management monitors thousands of signals in real time, enabling proactive threat detection and dynamic portfolio adjustments that balance growth with protection.

- Generative AI democratizes personalized investing and personal finance management tools and solutions by lowering advisory costs by over 50%, opening access to tailored financial plans for startups, SMBs, and individual investors alike.

- AI investing is making data-driven investing accessible for both beginners and experienced investors, leveraging automation and advanced data analysis to inform smarter decisions.

- Cutting-edge AI algorithms like deep learning and neural networks uncover hidden market patterns and anomalies, delivering enhanced returns through smarter, continuous decision-making.

- Rigorous data science—clean preprocessing, smart feature engineering, and strict validation—is essential to build reliable AI models that adapt quickly in volatile markets.

- Transparent, ethical AI and proactive compliance are critical to maintaining trust and navigating evolving regulations, with explainable models preventing bias and ensuring accountability.

Dive deeper into how these AI tools are reshaping investing so you can stay agile, compliant, and competitive in today’s fast-moving finance landscape.

Introduction

What if every investment decision you made was backed by algorithms analyzing millions of data points in real time—spotting trends and risks before they even appear on your radar?

By 2025, AI-driven finance isn’t futuristic anymore; it’s transforming how startups, SMBs, and enterprises invest, trade, and manage risk with unprecedented speed and precision. AI is revolutionizing investment management by automating and enhancing financial decision-making processes, making portfolio optimization and trading strategies more sophisticated, accessible, and data-driven.

You’re about to discover how smarter algorithms are:

- Automating complex market analysis that no human can match

- Enhancing portfolio strategies with predictive insights

- Slashing operational costs like Norway’s $1.8 trillion sovereign wealth fund saving $400 million annually

This shift means more than just faster calculations; it’s a fundamental change in agility and decision-making that empowers you to act confidently amid market volatility.

We’ll unpack the AI technologies powering these breakthroughs, from deep learning models that mimic human intuition to real-time analytics that democratize personalized investing.

Along the way, you’ll get actionable insight on balancing AI’s power with human judgment and navigating the ethical and regulatory landscape shaping finance’s future.

What exactly does this mean for your investing approach? Starting with how AI mines mountains of noisy data to reveal hidden opportunities, the next sections show why embracing these tools isn’t optional—it’s essential.

Get ready to rethink investing through the lens of smarter, faster algorithms sharpening your competitive edge—without losing sight of the real-world challenges and responsibilities that come with powerful new tech.

The AI Revolution in Finance: Foundations and Key Trends in 2025

Artificial intelligence is reshaping finance with a speed and scale unseen before. AI is transforming financial markets by enabling faster, more informed decisions across trading, investment analysis, and risk management. By 2025, AI-driven tools have moved past experimentation, becoming core to how investments are made and financial services operate, with investment managers leveraging AI to gain a competitive edge.

Shifting Finance Models Toward Agility

Traditional finance models rely heavily on intuition and historical data analysis. While traditional methods often depend on manual processes and limited datasets, AI integration replaces guesswork with data-driven agility that reacts in real time.

Key shifts include:

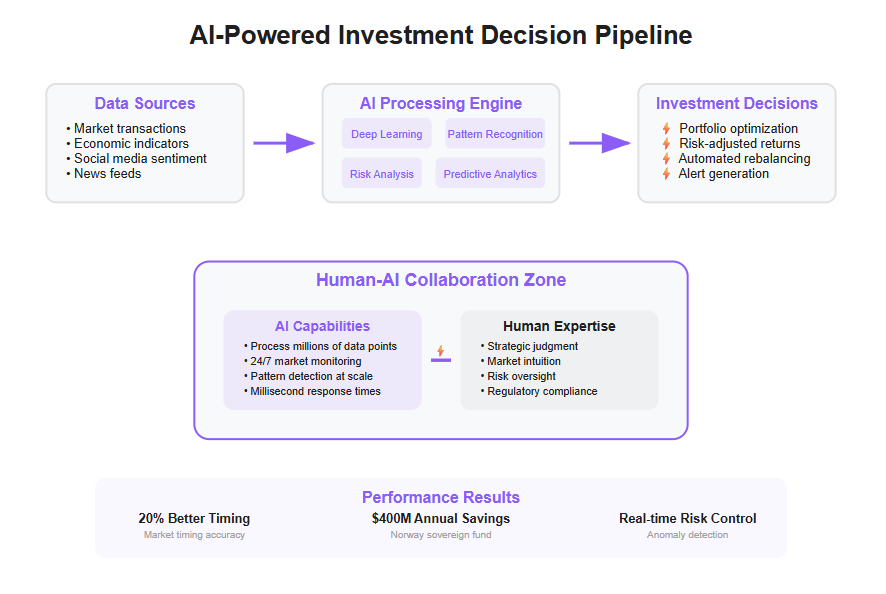

- Processing thousands of simultaneous data points—from trades to social media sentiment

- Automating complex analysis to spot patterns humans can’t see

- Allowing investors to act faster, reducing risk and improving returns

For example, Norway’s $1.8 trillion sovereign wealth fund expects to save $400 million annually by automating trading with AI, cutting down costly human errors and delays.

Core AI Technologies Powering This Transformation

Understanding these technologies helps you see how AI unlocks smarter finance:

- Machine Learning (ML): Algorithms improve by learning from new data, spotting trends in chaotic markets

- Deep Learning: Simulates human decision-making using layered neural networks, enabling sophisticated risk modeling

- Predictive Analytics: Forecasts market movements by analyzing vast datasets like economic indicators and news feeds

- Natural Language Processing (NLP): Enables AI to interpret and analyze unstructured text data from news, reports, and social media

Recent advancements include the use of large language models like ChatGPT, which analyze financial data, process unstructured information such as earnings transcripts and social media sentiment, and support investment decisions.

Together, these systems generate insights that guide smarter investing and efficient portfolio management.

Setting the Stage for Smarter Finance

Picture this: AI models continuously digest live market feeds, combining hard data and human sentiment to alert portfolio managers of subtle shifts before they snowball. Data access to proprietary and real-time sources gives institutions a significant edge in AI-driven finance, while individual investors often face limitations with only publicly available data.

This blend of real-time processing and predictive power is revolutionizing how investors navigate uncertainty, turning complex floors of trading into streamlined, precise operations.

Ready for deeper dives into specific AI applications? In upcoming sections, we explore how algorithmic trading, risk management, and financial inclusion all benefit from these AI foundations.

The takeaway: AI is not just a tool but the backbone of modern finance, delivering faster decisions, cost savings, and adaptive strategies in an increasingly volatile market environment.

Predictive Analytics: Unlocking Smarter Investment Opportunities

Predictive analytics is turbocharging how investors forecast market trends in 2025. By combining machine learning with vast datasets, it helps decode complex market signals and predict market movements by analyzing complex interconnections that humans alone can’t catch in real time.

AI-driven predictive analytics is also transforming investment analysis by providing deeper, more nuanced insights that improve decision-making beyond traditional methods.

Data Fuels Smarter Predictions

AI models analyze a rich mix of data sources, such as:

- Market transactions capturing real-time buying and selling patterns

- Macro economic indicators like GDP growth and employment rates

- Breaking news feeds and global events affecting markets

- Social media sentiment analyzing investor mood swings and trends

- Customer data providing insights into client behaviors, preferences, and financial activities

This data fusion creates a dynamic and holistic picture of market behavior, enabling AI to spot subtle shifts before they become obvious.

Maintaining high data quality across all these sources is essential for accurate AI-driven predictions and reliable investment insights.

Real-World Gains: Timing and Risk Mastery

Imagine AI flagging a sudden social media surge around a tech stock days before traditional analysts. Or detecting early economic downturn signals to adjust portfolios accordingly. Investors leveraging predictive analytics have reported:

- Improved market timing that enhances returns by catching trends early

- Enhanced risk assessment spotting vulnerabilities in portfolios before losses mount

For example, firms using AI-driven analytics reduced market timing errors by up to 20%, directly boosting investment performance.

Why Predictive Analytics Matters for Your Portfolio

By integrating predictive insights, portfolios become smarter and more adaptive. Here’s what you get with AI-based forecasting:

- More informed asset allocation decisions balancing risk and reward

- Enhanced portfolio optimization by evaluating risk, returns, and asset correlations for better investment strategies

- Automated, data-driven adjustments that save hours and reduce emotional bias

- Continuous learning models that evolve with fluctuating market conditions

Think of it as having an ultra-sharp financial radar constantly sweeping for investment opportunities—and shielding you from unseen risk.

Predictive analytics isn’t just a nice-to-have anymore; it’s a must-have tool to stay competitive in today’s fast-moving markets. If you want to outpace volatility and optimize your portfolio with cutting-edge AI, diving deeper into these methods is where to start.

“Predictive analytics turns noisy market data into actionable insights, offering a real edge in investment timing.”

“The future of investing belongs to those who harness AI to see tomorrow’s trends today.”

Ready to amplify your investing strategy with AI-driven forecasting? Check out How Predictive Analytics Can Unlock Smarter Investment Opportunities to get hands-on tactics and examples.

Algorithmic Trading: The New Standard for Market Efficiency

Evolution and Benefits of Algorithmic Trading

AI-driven algorithms have transformed trade execution, delivering lightning-fast speed and pinpoint precision beyond human capability.

These algorithms reduce typical trading errors caused by human bias and emotion, like panic-selling or overconfidence.

Data analytics plays a crucial role by processing large volumes of market and social media data to extract actionable insights, identify trends, and inform trading strategies.

Key AI models powering this shift include:

- Deep learning neural networks that recognize complex market patterns

- Quantitative models optimizing entry and exit points automatically

- Reinforcement learning systems adapting strategies in real time

Think of it as swapping your old, slow engine for a turbocharged AI that sees moves before others do.

Economic Impact and Cost Savings

The financial upside is massive—Norway’s $1.8 trillion sovereign wealth fund expects to cut trading costs by $400 million annually with AI.

How?

- AI detects internal buy/sell patterns to avoid unnecessary transactions

- Optimizes trade timing to minimize market impact and fees

- Automates routine trading tasks, saving countless labor hours

- Automates and secures financial transactions, improving efficiency and reducing fraud

This isn’t just a trend — it’s a multi-billion-dollar operational upgrade in finance.

[Explore more: Why Algorithmic Trading Is Revolutionizing Finance in 2025]

Collaborative Dynamics: Human-AI Partnerships in Trading

AI isn’t here to replace traders—it’s a supercharged co-pilot enhancing human decision-making.

Consider this: during a volatile market blip, AI flagged unusual activity, but human analysts intervened just in time to prevent a $300 million loss.

This synergy leads to:

- Hybrid workflows maximizing AI efficiency and human intuition. Asset managers are increasingly leveraging AI to support portfolio management and trading decisions, using advanced data analysis to inform strategies.

- New roles like “human-machine collaboration managers” ensuring smooth operations

- Greater resilience against unexpected market anomalies

Picture a trader and AI system working side-by-side like a pilot and co-pilot navigating through turbulent skies.

AI’s analytics plus human judgment = next-level market mastery.

Algorithmic trading is no longer optional—it’s a must-have efficiency engine driving cost savings, precision, and smarter, faster decisions. Embracing this human-AI duo will keep your trading game ahead of the curve in 2025 and beyond.

Mastering Risk Management with AI-Powered Strategies

AI is reshaping risk management by enabling finance teams to identify, analyze, and mitigate risks faster and more accurately than ever before.

It can monitor thousands of risk signals simultaneously, scanning market fluctuations, transaction anomalies, and external factors in real time for early warnings. AI also plays a crucial role in fraud detection by identifying suspicious patterns in financial data, helping prevent financial losses and enhancing security. This leads to improved risk management through AI-enhanced underwriting and analysis.

Real-Time Risk Detection at Scale

Here’s what AI brings to the table:

- Continuous monitoring of diverse data sources—from trading activity to social media sentiment

- Rapid identification of unusual patterns indicating potential fraud or systemic risks

- Automated alerts that empower teams to act before issues escalate

For example, Goldman Sachs uses AI-driven systems that analyze vast streams of data to flag suspicious transactions within milliseconds—cutting response times dramatically.

Smarter Portfolios, Lower Risk

AI doesn’t just catch risks; it optimizes them. Using predictive analytics and machine learning, portfolios are fine-tuned for risk-adjusted performance, balancing potential returns against volatility.

Investors get:

Dynamic risk scoring based on market shifts and portfolio changes

Scenario simulation to forecast impact under different conditions

Real-time rebalancing suggestions tailored to risk appetite

Enhanced financial modeling powered by AI, supporting advanced risk analysis and scenario planning

This means better protection against losses without sacrificing growth potential.

Why This Matters Now

Financial ecosystems are more interconnected and volatile than ever. AI-powered risk management reduces blind spots and reaction delays that human teams alone can’t handle.

Picture this: instead of a crisis spiraling out unchecked, AI systems detect emerging threats early, enabling timely interventions that save millions.

In short, AI transforms risk management into a proactive, data-driven process that improves speed, accuracy, and strategic insight.

Startups and SMBs looking to scale can leverage AI tools to safeguard their investments efficiently and stay ahead of unpredictable market twists.

Mastering Risk Management with AI isn’t just smart—it’s essential in 2025’s fast-moving finance world.

Financial Inclusion Through AI: Broadening Access to Personalized Investing

Generative AI is reshaping access to personalized financial advice by dramatically lowering costs. This shift means affordable, tailored investment plans are no longer reserved for the wealthy elite. AI now enables personalized investment advice for a broader range of investors, analyzing individual data to generate recommendations that adapt over time.

Additionally, AI-driven financial planning tools are making advanced strategies accessible to more people, further democratizing the benefits of sophisticated investment management.

How AI Makes Investing More Accessible

Robo-advisors powered by AI customize strategies specifically for each investor’s goals, risk tolerance, and financial situation.

Here’s what’s driving this transformation:

- Cost-efficiency: AI cuts advisory expenses by over 50%, making personalized advice reachable for middle-income clients

- Scalability: Automated platforms can handle millions of users without sacrificing tailored experiences

- Customization: AI algorithms analyze detailed profiles to recommend smart allocations and rebalance portfolios dynamically

Democratizing Wealth Beyond Wall Street

This technology breaks down traditional barriers, allowing everyday investors to tap into wealth management tools that used to be exclusive.

Picture this:

A startup founder can get a robo-advisor crafting a personalized portfolio while focusing on business growth — no expensive meetings or jargon-filled reports needed.

JPMorgan Chase: A Real-World Vanguard

JPMorgan Chase now uses AI to provide personalized financial solutions to millions, expanding access at scale.

They’ve reported:

- Major reduction in service costs

- Broader client reach, including underserved segments

- Enhanced user engagement through AI-powered recommendations

Key Takeaways You Can Use Today

Leverage AI-driven robo-advisors to offer clients affordable personalized investment services without heavy overhead.

Focus on client data customization to build dynamic portfolios that evolve with market conditions and personal goals.

Consider AI tools as growth multipliers—democratizing financial advice can unlock new client segments previously out of reach.

AI isn’t just changing who gets advice—it’s changing how advice is delivered, turning personalized investing from a luxury into an everyday reality for many.

“Generative AI is the gateway to democratizing wealth management—cutting costs and customizing advice at scale.”

Imagine an app that understands your unique financial story and updates your investment plan automatically as your life changes. That’s AI opening doors.

Unlocking personalized investment plans is no longer just a future promise—it’s happening now.

Cutting-Edge AI Algorithms Fueling Smarter Investments

AI algorithms are the secret engines powering smarter investment decisions in 2025. Hedge funds have been early adopters, leveraging advanced AI algorithms and predictive analytics to achieve superior investment returns and outperform traditional asset management firms.

At the forefront are:

- Deep learning models that analyze vast, complex datasets to spot hidden patterns.

- Neural networks mimicking the human brain’s structure for dynamic decision-making.

- Quantitative models leveraging mathematical frameworks for rigorous market analysis.

These advanced algorithms don’t just process numbers—they digest multiple data layers, including price fluctuations, economic trends, and even unstructured sources like news and social media sentiment. This multi-dimensional approach allows AI to detect subtle signals that human analysts might miss, fueling the rise of AI investing as a mainstream approach.

Pattern Recognition and Anomaly Detection in Practice

Imagine AI scanning thousands of market variables every second, instantly flagging unusual activity or emerging opportunities.

Key capabilities include:

- Pattern recognition that identifies consistent market behaviors for predictive insights.

- Anomaly detection spotting irregular trades or risk signals before they snowball.

- Sentiment analysis interpreting unstructured textual data to gauge market mood and inform investment decisions by capturing nuanced emotional cues.

- Dynamic adaptation as models learn from new data, continuously improving accuracy.

For example, Norway’s sovereign wealth fund leverages AI algorithms to trim $400 million in annual trading costs by recognizing internal buy/sell cycles and minimizing inefficient trades.

Gains in Performance and Risk Reduction

The link between advanced AI and financial outcomes is clear:

Increased returns through more precise timing and portfolio adjustments.

Reduced risks by early detection of market shifts or fraudulent activity.

Cost savings from optimizing trade execution and cutting unnecessary fees.

Think of these algorithms as your tireless investment analysts, scanning and recalibrating every moment to keep your portfolio ahead of the curve.

“AI algorithms transform data chaos into crystal-clear investment strategies.”

“Smart investing in 2025 means trusting AI to find what humans can’t see.”

“Behind every efficient trade is an AI model crunching complex signals in real time.”

This algorithm-driven edge is not just a future vision—it’s the here and now, reshaping how startups, SMBs, and enterprises tackle investing.

By harnessing these cutting-edge AI tools, financial teams can focus less on data overload and more on strategy—making smarter, faster decisions with confidence.

Explore more about these game-changing technologies in 7 Cutting-edge AI Algorithms Powering Smarter Investments in 2025.

Essential Data Science Techniques Behind Financial AI Models

Building accurate, efficient AI financial models hinges on mastering core data science techniques tailored for the fast-moving finance world. Without these, even the best algorithms stumble on noisy, complex datasets. High data quality is critical for reliable AI models, as well-structured and accurate data ensures trustworthy insights and effective risk management.

These techniques are transforming investment management by enabling more sophisticated, data-driven decisions that enhance portfolio optimization, trading strategies, and wealth management.

Data Preprocessing: The Foundation of Reliable Models

Raw financial data is messy—full of missing values, outliers, and inconsistencies from sources like market feeds and economic indicators.

Successful AI models start by:

- Cleaning and normalizing data to ensure consistency

- Handling missing values logically to avoid bias

- Removing outliers that could skew results

Think of it like setting a clean stage for an orchestra—every instrument (data point) must be tuned before the performance (modeling) starts.

Feature Engineering: Extracting What Really Matters

Feature engineering is the art and science of transforming raw inputs into meaningful predictors.

In finance, this can look like:

- Crafting indicators from price trends (moving averages, volatility)

- Encoding economic cycle phases or sentiment scores from news feeds

- Creating composite risk factors that blend multiple signals

Picture a chef selecting the freshest ingredients to create a recipe; these crafted features flavor your model’s predictions.

Model Validation: Avoiding Costly Mistakes

A financial AI’s value depends on trustworthiness. Rigorous model validation ensures predictions won’t crack under real-world pressure.

Key steps include:

- Splitting data into training, validation, and test sets to measure performance fairly

- Using cross-validation to reduce overfitting in volatile markets

- Monitoring metrics like precision, recall, and profit-impact curves

For instance, Goldman Sachs boosted risk assessment accuracy by 30% using tailor-fit validation pipelines paired with AI systems.

Continuous Learning and Adaptation: Staying Ahead of Market Moves

Markets evolve daily. Models that go stale quickly lose value and increase risk. Continuous learning pipelines recalibrate models by:

- Incorporating recent data trends automatically

- Detecting shifts in financial regimes or unexpected events early

- Reducing manual intervention for faster response times

Imagine your AI model as a savvy trader who tightens their strategy with every market wave.

Quotable insights:

- “Feature engineering turns raw market noise into profitable insights.”

- “A model without validation is like playing poker without checking your cards.”

- “Continuous learning is the secret sauce for staying competitive in 2025’s finance race.”

By focusing on clean data, smart features, strict validation, and adaptive learning, you arm your AI models for smarter investment decisions that keep pace with a dynamic market landscape.

For a deeper dive, see 5 Essential Data Science Techniques for Smarter Financial AI Models.

AI System and Decision Making: How Machines Shape Financial Choices

Artificial intelligence has become the backbone of decision making in the financial sector, empowering financial institutions to move beyond traditional analysis and embrace a new era of data-driven investing. Today’s AI systems are designed to analyze vast amounts of information—ranging from historical data to unstructured data like news articles and social media posts—to uncover actionable insights that inform investment strategies.

By leveraging artificial intelligence, investment firms can anticipate market trends with greater accuracy, optimize portfolio management, and make more informed investment decisions. AI in finance enables the rapid processing of market data, allowing investment professionals to react to shifting market dynamics in real time. This capability is transforming how the financial sector approaches everything from asset allocation to risk assessment, giving firms a competitive edge in a landscape defined by complexity and speed.

The result? Investment strategies that are not only more responsive to current market trends but also better equipped to manage risk and seize new opportunities. As AI systems continue to evolve, their ability to analyze vast amounts of data will only deepen, further enhancing the quality and precision of investment decisions across the industry.

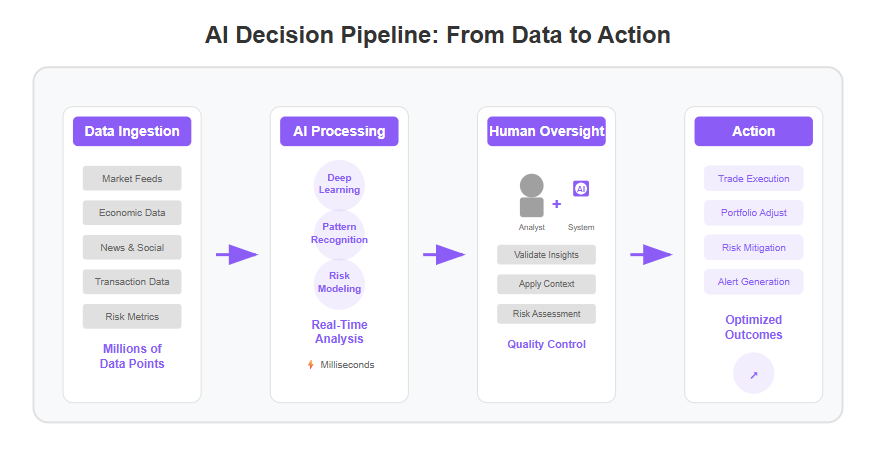

From Data Ingestion to Action: The AI Decision Pipeline

The journey from raw data to actionable investment decisions is powered by a sophisticated AI decision pipeline. It all begins with the ingestion of massive volumes of structured and unstructured data—everything from financial statements and trading records to news headlines and social media sentiment. AI tools are uniquely equipped to process and synthesize this information, identifying patterns and trends that might otherwise go unnoticed.

Once the data is collected, machine learning models step in to analyze these data points, generating predictions and recommendations tailored to current market conditions. These models are trained to recognize subtle signals in both structured and unstructured data, enabling them to forecast market movements and suggest optimal portfolio adjustments.

A prime example of this in action is the Amplify AI-Powered Equity ETF (AIEQ), which uses AI-powered algorithms to scan thousands of data points daily. The ETF’s machine learning models evaluate a wide array of inputs to make real-time investment decisions, continuously optimizing portfolio management for performance and risk.

By automating the entire pipeline—from data ingestion to decision execution—AI tools empower investment professionals to act swiftly and confidently, ensuring that portfolios remain aligned with evolving market dynamics.

Balancing Automation and Human Oversight

While AI systems excel at analyzing vast amounts of data and generating investment recommendations, the human element remains indispensable. Investment firms recognize that even the most advanced ai models can be subject to bias or blind spots, especially when faced with unprecedented market events or shifts in market sentiment that fall outside historical patterns.

Human analysts play a critical role in reviewing and validating the outputs of AI systems, applying their expertise and judgment to ensure that investment decisions are both prudent and contextually sound. This collaborative approach allows firms to harness the speed and scale of AI while safeguarding against potential pitfalls.

By balancing automation with human oversight, investment firms can analyze vast amounts of information more effectively, leveraging the strengths of both AI systems and human judgment. This synergy leads to more informed investment decisions, greater resilience in the face of market volatility, and a higher standard of accountability in the investment process.

Transparency and Explainability in AI-Driven Decisions

As AI-driven decision making becomes central to finance, transparency and explainability are more important than ever. Investment firms must be able to understand and articulate how their ai models arrive at specific recommendations—both to satisfy regulatory requirements and to build trust with clients and stakeholders.

Techniques such as feature attribution and model interpretability are essential tools in this process. They allow investment professionals to see which factors most influenced a model’s prediction, making it possible to explain complex decisions in clear, understandable terms. This level of transparency not only supports compliance but also reassures investors that AI systems are being used responsibly and ethically.

Ultimately, prioritizing transparency and explainability in AI-driven decision making enables investment firms to optimize portfolio management, improve risk management, and make more informed investment decisions. By fostering trust and accountability, these practices ensure that the integration of AI in finance delivers on its promise of smarter, more effective investing—while upholding the highest standards of integrity in the financial sector.

Navigating Regulatory and Ethical Challenges in AI-Driven Finance

Algorithmic Bias and Transparency Concerns

AI’s growing role in finance isn’t without pitfalls. Biased algorithms can skew investment decisions, unfairly disadvantaging certain groups or market sectors.

Opaque models create a “black box” effect, leaving traders and regulators in the dark about how outcomes are reached.

Financial firms urgently need:

- Explainable AI frameworks that clarify decision paths

- Accountability standards to prevent unchecked algorithmic harm

Picture this: an AI flags an asset as risky without revealing why, causing overcautious sell-offs — explainability could’ve prevented costly mistakes.

Data Privacy and Security Imperatives

Sensitive financial and personal data is fuel for AI, but also a prime target for cyberattacks and misuse.

Protecting data means:

- Encrypting information end-to-end

- Implementing strict access controls

- Continuously monitoring for breaches

Given the complexity, even a single vulnerability can expose millions of records, shaking trust and inviting fines.

Regulatory Developments and Compliance Strategies

AI regulation is evolving fast yet remains a moving target. Authorities now focus on adaptive, technology-neutral policies that neither stifle innovation nor sacrifice consumer protections.

Key trends include:

- Emphasizing transparency and auditability

- Encouraging cross-jurisdiction collaboration

- Mandating fairness reviews for AI-driven decisions

The rapid expansion of AI in finance is underscored by its impressive compound annual growth rate (CAGR), highlighting the increasing investment and adoption across the industry.

For example, the European Union’s Digital Finance Package pushes for rules that balance innovation momentum with market fairness.

Growing demand for AI compliance roles means startups and SMBs must embed regulation-aware practices early to avoid costly setbacks.

In short, navigating AI’s ethical and regulatory landscape requires proactive transparency, robust data security, and agile compliance strategies.

Successfully balancing innovation with accountability doesn’t just protect your business—it builds trust that wins clients and regulators alike.

“Bias without transparency is the silent dealbreaker in AI finance.”

“Protecting data is as crucial as building smarter algorithms.”

“Adapt your compliance strategy like tech evolves—rapidly and thoughtfully.”

Future Outlook: Scaling AI’s Role While Managing Complexities

The finance world is set to undergo another leap as AI integration expands across asset classes and regions. By 2025, expect AI tools not only in stocks and bonds but in commodities, real estate, and emerging markets.

Advancing Human-AI Collaboration and Transparency

Smart finance won’t be AI versus humans — it’s about collaboration.

- New roles like human-machine workflow managers will bridge AI insights and trader intuition

- Enhanced tools will provide clearer explanations for AI-driven decisions, boosting trust and usability

- Picture an AI flagging a subtle market anomaly while a human expert weighs in to confirm or adjust strategy

This blend of speed and nuanced judgment is shaping next-gen investing.

Shifting Market Dynamics and Regulation

Automated trading continues to evolve — and so does its market footprint.

- Expect increasing regulatory attention on automated trading behaviors and algorithmic fairness

- Governments emphasize adaptive, technology-neutral policies balancing innovation with risk control

- Institutions will face the challenge of staying compliant without slowing AI-driven agility

For example, Norway’s $1.8 trillion sovereign wealth fund aims to cut $400 million in trading costs through AI, but must navigate these new regulatory waters carefully.

Preparing Startups, SMBs, and Enterprises

No matter your size, getting AI right is a competitive edge.

- Prioritize scalable AI adoption strategies tailored to your business realities

- Invest in talent that can manage both AI systems and evolving compliance standards

- Focus on flexible, modular AI solutions that evolve with market demands

Real-world takeaway: building AI capability isn’t a one-off project—it’s an ongoing journey.

Key Takeaways to Act On Today

- Start integrating transparent AI workflows now to build trust with stakeholders

- Train teams on both AI tools and regulatory shifts to stay ahead of compliance challenges

- Don’t just automate; embrace human-AI partnerships that balance speed and judgment

AI in finance is less about replacing humans, more about sharpening their edge—if you prepare smartly, you’ll ride the wave, not get swept away.

The future isn’t just fast algorithms—it’s strategic collaboration, smart regulation, and adaptable innovation that together will redefine investing in 2025 and beyond.

Conclusion

AI is no longer just a futuristic concept in finance—it’s the engine driving smarter, faster, and more adaptive investing strategies in 2025. By harnessing AI’s power to analyze vast data, manage risk dynamically, and optimize trading decisions, you position yourself to outperform in an increasingly volatile market.

Embracing AI isn’t about replacing human insight; it’s about supercharging your decision-making with predictive precision and operational efficiency. The startups, SMBs, and enterprises that move quickly to integrate AI-driven tools will unlock cost savings, sharpen risk controls, and access personalized strategies previously out of reach.

Here are your essential takeaways to start fueling your AI-driven finance journey today:

- Adopt scalable AI workflows that balance automation with human judgment

- Leverage predictive analytics to identify opportunities and risks before they escalate

- Prioritize rigorous model validation and continuous learning to keep strategies adaptive

- Embrace AI-powered collaboration, blending expert intuition with real-time insights

- Build proactive compliance and transparency practices to safeguard trust and growth

Ready to act? Start by auditing your current investment or trading processes to identify where AI can add immediate value. Explore pilot projects with AI-powered predictive tools or robo-advisors focused on your key goals. And invest in upskilling your team to become fluent in AI capabilities and ethical regulation.

Remember, the future of finance in 2025 will reward those who don’t just keep pace—but who propel forward with confidence and clarity. When AI and human expertise join forces, smarter investing isn’t just possible—it’s inevitable.

“Smart finance is no longer about guessing the market but about letting AI illuminate the path ahead.”